The impact open source hardware has had in the past year has been momentous. Educators, students and hobbyists have all traditionally been big proponents of open-source hardware, but in the last 12 months we finally saw large companies and professional engineers begin to openly embrace the open source movement as well.

Open source hardware is the affordable building option of the future and has assumed a position at the forefront of a growing electronic components market.

For the unfamiliar, open source hardware is hardware whose design has been made widely available to study, modify, distribute and build upon.

Any designs or hardware that use or modify this hardware may be sold by the developer. Some of the most popular open source hardware products include the hugely popular SBCs Raspberry Pi and Beaglebone Black.

Importantly, open source hardware provides people with the opportunity to take full control of the technology and freely share their knowledge with others – who in turn are encouraged to do the same.

These principles may sound familiar – they are the same ones adhered to by open source software, such as Mozilla’s Firefox internet browser, or the GNU/Linux operating system.

Designers have already discovered a seemingly endless number of applications for open source products; from capturing images in space and powering robots, to controlling home devices and processing word documents.

Their functions and uses are only limited by the imagination of the developer and, by encouraging users to learn how they work and share this knowledge with others, open source hardware is making programming and design engineering more accessible to everyone

To underline the significance of this, we surveyed 4,000 professional electrical design engineers and 4,000 students and hobbyist designers.

The survey found that 56% of professionals made more use of open-source hardware in 2013 than in any previous year. Amongst students and hobbyists that number rose even further, with more than 80% planning to make more use of open source hardware than they had in the past.

Clearly the impact of this is an increased emphasis on ease of access and use of electronic components, as well as the need for a strong community that can help bring these ideas and designs to life.

But more significantly, if we are seeing open-source hardware gain traction then there is a growing need for electronics distributors to adapt if they wish to remain relevant to these users – it’s no longer enough to just sell open-source components.

Due to the sheer availability of open-source tools and resources, many of the traditional risks associated with designing in open source for commercial use have been mitigated.

This mitigation has also led to the rise of a complete line of new development kits and accessories dedicated solely to open source hardware. As a result, the landscape has shifted and both distributors and manufacturers need to encourage further open-source lines if they wish to keep up with changing demand.

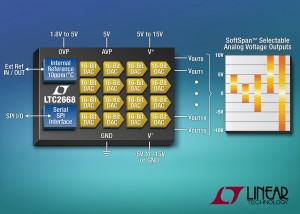

As an example, we partnered with major silicon providers in order to develop new open source platforms, with the aim of giving people access to technologies they wouldn’t traditionally have access to. This ensures low-cost development tools are available in an environment where developers can work on those tools and share their knowledge.

But the real shift will need to be seen long-term, after sales support.

With the rise in the use of open-source hardware, this is no longer optional if a distributor wishes to support engineers at all stages in the design process.

A good distributor will provide customers with free tools and the opportunity to work with other engineers, to both speed up their prototyping and make their lives easier.

This can cover something as specific as learning how to program a microprocessor, help with using and installing operating systems, or aiding in the discovery and application of new technologies – such as sensing, lighting, displays and I/O control.

Now we are halfway in to 2014, I’d expect that an updated survey would show further traction having been made across professional engineers, hobbyists, educators and students. As the tools used by both professionals and hobbyists continue to crossover, no doubt we will start to see even more significant impacts upon the workplace.

If both groups are using a Beaglebone Black in their designs, there’s no doubt they’ll be using many of the same tools and resources to achieve their goals. The fact that one is using these tools and accessing this information whilst in the workplace, and another in his home is inconsequential.

The impact of this cannot be overstated, with few other trends or products managing to influence the purchasing and design preferences of everyone from suppliers, to engineers, makers, students and beyond. The real challenge for those of us in the industry is in making sure we adapt in such a way that we are meeting the needs of the developers using these new products and enabling them to share their knowledge.

Writer is Richard Curtin, global director of strategic alliance, Premier Farnell