Discovery kit for STM32 F0 microcontrollers

If the design engineer’s choice of microcontroller was simple once, it certainly is not now.

Massive improvements to the processor capabilities, availability of peripherals and power-saving functions of microcontrollers have created huge new opportunities for OEM designers to develop new products and to improve the performance and features of existing products.

But the development in technology has also made the range of microcontroller choices more complex, just at the time when OEM designers are becoming more stretched, with less scope to specialise and facing a greater requirement to keep adding and extending their products’ features.

Now help is at hand. In the first initiative of its kind, Future Electronics has become a corporate accreditation partner of ARM.

The aim is to enable customers to benefit from the specialist and advanced ARM expertise of its field applications engineers, to help them make the right, independent choice of microcontroller architecture and core, and to implement it effectively in their end-product design.

Of course, it will surprise no-one to say that the factors affecting designers’ choice of microcontroller core are complex and constantly changing.

The success of ARM has enabled it to continually invest in developing new cores, so that the breadth and diversity of the ARM core range has increased.

At the same time it is not always obvious to OEM designers how to differentiate between one microcontroller manufacturer’s ARM-based device and another’s: in many cases, the main selling point of an ARM Cortex-M3 MCU, for instance, is precisely that it features an ARM Cortex-M3 core. So on the surface, all ARM Cortex-M3 MCUs can look similar.

This means that a distributor with technical expertise can help designers evaluate the underlying differences effectively, as well as make the right choice of core. Distributors are very well placed to perform this function.

In many cases, OEM designers have to maintain wide-ranging knowledge covering many aspects of hardware and software technology; a distributor’s specialist FAEs, on the other hand, will generally spend most or all of their time supporting MCUs.

By virtue of the job the FAEs do, therefore, they can offer their customers a deeper knowledge of the universe of core and MCU choices available.

The problem for distributors, however, is to find a way to give OEM customers confidence in the strength and depth of any individual FAE’s knowledge.

Now there is a scheme by which FAEs will become ARM Accredited MCU Engineers (AAMEs).

Future Electronics has invested in qualifying some 45 of its engineers worldwide to be ARM-accredited trainers.

These colleagues are in turn now training Future Electronics FAEs (in EMEA, some 70 or so engineers); by March 2015, all Future Electronics FAEs in the EMEA region will have gained AAME status.

i.MX6 Quad Core 1GHz Multimedia Processor Development Board w/WiFi and Bluetooth

The AAME qualification is highly regarded in the industry, and can only be gained after examination conducted by an independent educational testing company. The AAME syllabus has a particular emphasis on microcontrollers and the ARM Cortex-M processors, the most widely used ARM devices.

We are core-agnostic: the discussion with a customer will not start from the assumption that it is to use an ARM core.

For some customers, MIPS or AVR platforms are a more appropriate choice. Every discussion at the system-architecture stage will be based on the requirements of the application, and particularly the parameters of power consumption, speed, memory footprint, peripherals and cost.

The trend underlying our decision to invest in ARM accreditation can also be found in other technology areas than the MCU.

For instance, manufacturers which are trying to add internet connectivity to their products, or to improve the efficiency of their product’s power supply, are looking for specific expertise. RF and wireless communications technology is beset by a jungle of standards and technologies, which dedicated experts are able to cut through on behalf of the OEM.

In the same vein, we see rising demand for development platforms. This has led us to open the FTM Board Club, the online community for development engineers, to all-comers, whether they are customers of Future Electronics or not. Here, we provide a wide range of high-quality development tools free of charge for developers.

Overall, the addition of ARM Accreditation Partner status to the existing range of technical services is designed to meet the changing, and growing, needs of OEM design engineers for specialist engineering expertise.

As a distributor, it is our job to help our customers get to market faster with better and more valuable end products. With our unique level of ARM expertise, I believe that we are in the best position possible to perform this function.

Writer is Ralf Buehler, managing director, Future Electronics (EMEA)

richard wilson

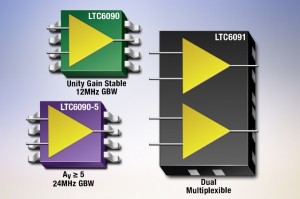

Linear Technology’s latest precision operational amplifiers can be operated on a supply voltage up to 140V (±70V).

Linear Technology’s latest precision operational amplifiers can be operated on a supply voltage up to 140V (±70V).