Motor control is becoming the power industry’s fastest changing technology area. The reason for this is the requirement to improve energy efficiency from the millions of motors which are used in our homes, factories and cars.

Motor control is becoming the power industry’s fastest changing technology area. The reason for this is the requirement to improve energy efficiency from the millions of motors which are used in our homes, factories and cars.

New developments in motor controller design, current sensing and control algorithms will be needed if new and more stringent efficiency targets are to be achieved.

The main design elements of motor control can be broken down into four parameters – communications interface, EMC robustness, circuit isolation and energy efficiency.

It is in the area of energy efficiency where the biggest changes are likely to take place in the next few years.

According to Anders Fredriksen from Analog Devices, there is a big push to put more importance on energy efficiency in motor design, and this will increase over the next few years as new efficiency standards are introduced.

“Standardisation has been going on for decades but by 2017 extensions to energy efficiency guidelines being applied to motors down to 1W will have the biggest impact for manufacturers,” said Fredriksen.

But Frederiksen believes further advances in motor control design are still needed to meet the requirements of the new energy efficiency standards.

“There may be a need to change motor control architectures, we won’t achieve all the new efficiency standards without this,” said Fredriksen.

This will apply to the industrial motors as well as those in household appliances and cars.

This drive to increase energy efficiency needs to be applied at the component level. This means adding processor power to motor controllers to run the optimisation algorithms. It also requires increased accuracy when current sensing.

“For example, the use of isolated sigma-delta conversion for higher accuracy,” said Fredriksen.

ADI offers a high accuracy isolated sigma-delta converter for dc and ac current and voltage measurement.

The AD7403 achieves 81dBmin signal-to-noise and distortion ratio (SINAD, at 78ksample/s over -40 to 125°C). Higher SINAD enables more accurate current and voltage measurement which improves the performance of motor drives by reducing torque ripple on the motor shaft.

It has a second-order, sigma-delta modulator that converts an analogue input signal into a single-bit data stream with on-chip digital isolation (1,250Vpeak) through on-chip transformers.

Operation is from 5V at the measurement end and it accepts a differential input signal of ±250mV (±320mV full-scale). The analogue input is continuously sampled and converted to a ones-density bit stream with a data rate of up to 20MHz. The original information can be reconstructed with appropriate digital filtering to achieve 88dB signal to noise at 78.1ksample/s.

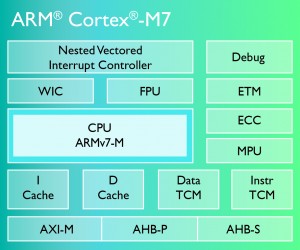

For data processing, microcontrollers are moving to higher performance cores such as the ARM Cortex-M4, which has DSP extensions.

“There has been a lot of work going on around algorithm development for motor control, the increase in processing capability which cores like the Cortex-M4 provide has brought these advanced algorithms into play,” said Fredriksen.

For example, minimising torque ripple on the motor shaft can improve productivity.

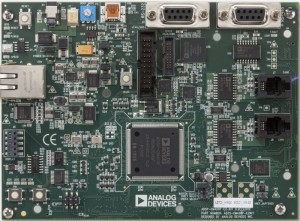

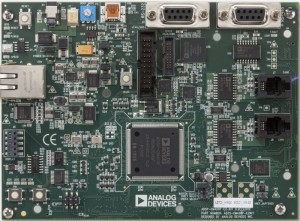

Analog Devices has combined an ARM Cortex-M4 processor and a model-based design platform to address the needs of closed loop motor control.

The floating-point Cortex-M4 processor core runs at 240MHz and ADI has also integrated a dual 16-bit A/D converter with up to 14 bits of accuracy and 380ns conversion speed.

ADI’s previous motor controller platform was based on its own ADSP-BF506A Blackfin processor, but it has realised that the Cortex-M4 was quickly becoming the de facto standard architecture for accurate control systems.

Fredriksen also believes that model-based design tools such as Simulink from the MathWorks are now becoming important in the development of control systems for motors and PV arrays.

Two years ago ADI demonstrated its first motor control system design platform, based on a Blackfin processor, using the MathWorks Matlab computing language for algorithm development.

It also implemented the Simulink design environment for the deployment of control algorithms to optimise the efficiency of permanent magnet synchronous and ac induction motors.

The intention was to allow designers to model their system in Matlab/Simulink, generate the C code, and deploy with Analog Devices’ Visual DSP++ Design Environment with bandwidth remaining for application code.

Fredricksen believes that the use of model-based designs can improve the drive efficiency of sensorless and sensored motor control algorithms.

ADI has worked with the MathWorks to apply the Simulink model-based design tool and code generator to its motor control platform. It uses the MathWorks’ ARM Cortex-M optimised Embedded Coder and tool suites to support the complete design cycle from simulation to product-ready code implementation in an embedded platform.

Simulink generates optimised C code which runs on the Cortex-M4 based platform. The company has also increased the on-chip memory to 384kbyte of SRAM to hold the C code generated by the tool.

The ADSP-CM40x has control loop specific hardware accelerators, a full sinc filter implementation to interface directly to isolated sigma-delta modulators which are used in shunt-based current sensing system architectures. Typically, the sinc filter would have been implemented in an FPGA.

There is also a DSP accelerator providing harmonic analysis typically used in PV array control loop design.

It is also capable of scalable and dynamically adjustable PWM.

There is a development and evaluation board, CM40xEZBoard, supported by standard control algorithms.

richard wilson