Dr Khasha Ghaffarzadeh

The market transparent conductive film which is used in the production of displays, solar cells and touch screens, will reach $1.2bn in 2025 at the film level (ITO-on-glass, LCD and OLED displays are excluded), writes Dr Khasha Ghaffarzadeh, head of consulting, IDTechEx.

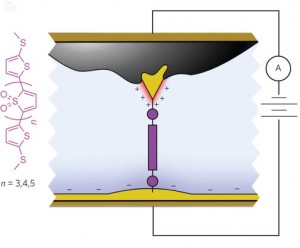

Displays and solar cells need light to enter at least one side of the device. At the same time, they have to close a circuit and therefore require a transparent conductive film (TCF).

The mainstay material is indium tin oxide (ITO) on glass, which has proven excellent but has several short comings. For example, for larger area touch screens, ITO becomes too resistive for desired rapid response touch sensing.

For the new wave of flexible displays, ITO also cracks under little strain. Additionally, indium supply is also heavily controlled. Therefore over 50 companies around the world, from small to large, have been pursuing replacing ITO, and over 10 types of solutions exist.

ITO on PET rather than glass will dominate, but ITO alternatives will reach a combined market value of $430m in 2025. This market will be very unevenly spread between different ITO alternative technologies with silver nanowires and metal mesh taking a lion’s share ($317m in 2025).

Touch-related applications currently dominate the sales of TCF films, although the end markets are beginning to change. Currently, the share of non-touch markets is <<5%, but IDTechEx Research expects it to reach a substantial 17% in 2025.

These emerging applications include smart windows, OLED lighting, emerging photovoltaics, reflective displays, and more. They, together with larger-sized or flexible touch screens, will shape the requirements landscape of this sector.

Challenging market conditions

Strong trends have long undermined the dominance of the incumbent, the ITO films. Most notable are trends towards lower sheet resistance, increased flexibility and reduced cost.

These trends continuously push ITO films towards or even beyond its performance limit, thus triggering the proliferation of ITO alternative (substitute) technologies and suppliers.

The incumbents have however responded using a two-pronged strategy: (1) doubling the production capacity worldwide and (2) slashing prices at the expense of profit margins.

The former strategy ensures that there no longer exists a tight supply-demand relationship, making this once again a strong buyers’ market. The latter strategy ensures that incumbents don’t lose a client solely on price. Indeed, they lower their prices piecemeal every time an alternative is to close a deal.

These are classic symptoms of a market characterized by a strong threat of substitutes. Here, the end customer is happy but the ITO alternative suppliers face make-or-break years, whilst ITO suppliers (incumbents) are now engaged in a low-margin game of share protection.

The market conditions were made more challenging because growth in emerging sectors in which ITO alternatives commanded a clear performance advantage undershot expectations.

We anticipate that these market forces will trigger a consolidation phase in the industry during which ITO alternative leaders will emerge, whilst many poorly-funded and poorly-differentiated suppliers will disappear.

At the same time, we believe that the value proposition for leading ITO alternative technologies remains compelling. They will become a market reality although their journey will be slow because ITO films remain good enough for most existing applications. Therefore, at least initially, their success is linked to the growth of new types of devices, such as larger area devices.

The performance bar has been raised

Silver nanowires and metal mesh offer a lower sheet resistance than both ITO and other alternatives without significantly compromising optical quality. Their pricing strategy continues to be based on undercutting ITO to maintain a more-for-less value proposition, although this is becoming increasingly challenging.

In fact, they have increased the performance bar so high that the likes of carbon nanotubes and graphene will be blocked out of the main markets and be pushed towards niche use cases.

This suggests that developers of these technologies need to be imaginative again and build on their stronger differentiators such as stretchability, thermoformability, etc. This change of focus is already underway but will come too late for some.

The battle between metal mesh suppliers will be fought on narrowing the linewidth and improving throughput and yield (biggest cost unknown/driver). Amongst silver nanowire suppliers, haze was a point of contention, but now attention is focused on innovation at the formulation level. Here, the first mover advantage will also matter whilst the IP landscape is now no longer white, which further prevents access to new comers.

The next phase of innovation will focus on more hybrid systems and disruptive ways of patterning.

IDTechEx Research has released a new research study titled “Transparent Conductive Films (TCF) 2015-2025: Forecasts, Markets, Technologies”.

Richard Wilson