Reduction in energy use is high on the agenda of customers, who have to pay for wasted energy, utilities which need to keep pace with growing energy consumption, and of governments, who have to handle the macro-effects of global warning.

Reduction in energy use is high on the agenda of customers, who have to pay for wasted energy, utilities which need to keep pace with growing energy consumption, and of governments, who have to handle the macro-effects of global warning.

Whether the need is to effectively control new lighting technologies, to fully power down systems on standby, or to protect smart meters against illegal tampering, relays and switches are playing a central role in making the next generation of electronic and electrical systems energy efficient and make a real contribution to the overall reduction of energy use.

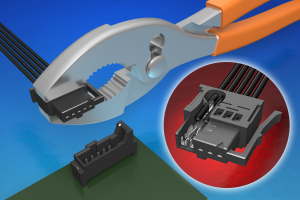

Switch and relay manufacturers are responding to these needs. For example, new latching relays are designed to help save energy in lighting control systems. New switches can be remotely controlled, allowing a system to be fully isolated automatically if required. Tamper proof switches, DC power relays and other designs are also coming on the market to support the new wave of eco-friendly electronics and energy saving systems.

Latching relays

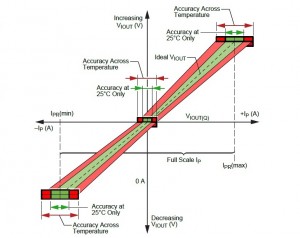

Lighting technologies such as fluorescent and LED lamps are much more efficient, but energy can still be wasted if they are not switched off when the room is unoccupied.

Users can’t be relied on to do this, and automatic control systems are becoming commonplace and sometimes even mandatory. These systems rely on a switch or relay to actually effect the switching, but these have to cope with the high inrush currents associated with the starter capacitors in fluorescent lights and LED driver circuits.

Latching relays that are only energised while switching and use less power than non-latching designs are by far the best and most efficient approach. Two new energy saving latching relays from Omron feature the capacity to handle these high inrush currents.

Latching relays are also central to smart meter design, to implement the remote disconnect function required for load management, time of day (ToD) tariff-switching, disconnect and pre-payment. To achieve low overall meter power consumption a bi-stable latching relay design with the highest electrical performance is desirable. This is a very specialist application, with very specific requirements. Considerations include small overall size to minimise the size of the meter and resistance to tampering using an external magnet.

Latching relays are also suitable for movement control, smart meter, power line switching and sub metering applications.

Remote reset switches

One of the key goals of the Eco-Design Directive is to limit, and eventually eliminate, standby power. Electromechanical switches can completely power down a system, but until now a limitation has been that they need to be manually actuated.

Remote reset switches provide a great solution, drawing no power until they are activated and therefore are helpful in implementing systems that eliminate standby power and meet the European Commission ErP Ecodesign directive.

Versions of these switches can also address the issue that some systems need to follow a set shut-down sequence to avoid loss of data or circuit damage. For example, capacitors may need to be discharged before a system can be regarded as safely switched off.

To address this, remote reset switches with a delayed off function are available to allow safe shut down of electrical equipment. With such switches, the power to the system is maintained when the switch is returned to the off position. The system is then powered down by an external signal after an interval determined by the designer.

These remote switches are suitable for a range of industrial and consumer electrical applications and even support high inrush currents to TV-8 standards.

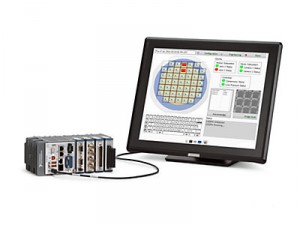

Tamper proof switches

Remote reset switches is just one example of the way in which switch design is evolving to address new requirements. For example, an issue with smart meters, industrial control systems and other applications is tamper detection.

A switch is commonly used to detect when the cover of a system has been opened. Smart meter anti-tamper switches may not be actuated for years, but should still operate reliably should the meter be attacked after this period.

Switches for this application, such as the Omron D2FS sub-miniature snap-action switch, are designed to support long term operation even with very low switching frequencies. This switch incorporates a single-leaf movable spring and an edge shaped fixed contact, which exerts a high contact force per square metre and aids wiping movement keeping the contact surface clean.

It is a challenge for electronic designers to ensure that off really does mean off for the systems that they design. The Eco-design directive puts regulatory force behind this need, but truthfully customers are increasingly aware of the cost of energy, and leaving a system powered when not in use can affect its safety and service life too. Human users cannot usually be relied on to turn off equipment when it isn’t required, and some form of automation is required.

Switches and relays are inherently energy efficient as they will fully disconnect a system or sub-system from its power supply, so that it is properly powered down when not in use.

New products designs use less energy in themselves and are easier to actuate through software. These switches and relays can make a real contribution to creating a new generation of systems that are more efficient, cost less, are more reliable, and at the same time meet or exceed the requirements laid down in EU and other directives.

Andries de Bruin is European product marketing manager, Omron Electronic Components Europe.

richard wilson