Intel and Micron plan to have samples of a 128Gbit 3D crosspoint memory by the end of the year with commercial shipments in 2016.

Intel claims that the new memory, which it calls XPoint, writes ‘up to 1000 faster than NAND’ and has 1000 times the endurance of NAND.

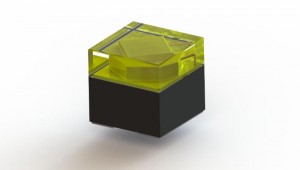

The memory has a cross point array structure described, in the press release, as a “3D checkerboard where memory cells sit at the intersection of word lines and bit lines, allowing the cells to be addressed individually. As a result, data can be written and read in small sizes, leading to faster and more efficient read/write processes.”

The release adds:

“More details about 3D XPoint technology include:

Cross Point Array Structure – Perpendicular conductors connect 128 billion densely packed memory cells. Each memory cell stores a single bit of data. This compact structure results in high performance and high-density bits.

Stackable – In addition to the tight cross point array structure, memory cells are stacked in multiple layers. The initial technology stores 128Gb per die across two memory layers. Future generations of this technology can increase the number of memory layers, in addition to traditional lithographic pitch scaling, further improving system capacities.

Selector – Memory cells are accessed and written or read by varying the amount of voltage sent to each selector. This eliminates the need for transistors, increasing capacity while reducing cost.”